What happens when a woman in her late 80s is hit by a car and her own insurance company doesn’t want to make good on its policy? If the woman has no way to fight, the insurance company will probably get its way. This is the story of a woman who fought.

Jeep vs. Woman

Carol W.* was exiting a store on foot when a Jeep went in reverse and knocked Carol down. Carol suffered elbow and pelvic fractures and spent three months in physical rehabilitation with various complications. Because of the driver’s negligence, Carol’s life was turned upside-down.

From Being a Walker to Needing a Walker

Before the impact, Carol walked a mile on the treadmill while listening to marching band music and never used a walker or wheelchair. After the impact, Carol was forced to use a walker and wheelchair, which left her unable to walk her dogs or use the stairs at her house. She couldn’t go see her friends whenever she wanted—her independent life was taken from her. The collision made it so that Carol, a vibrant and active elderly person, could no longer live without assistance. From the moment the car hit her, Carol was no longer able to function as an independent adult.

The Realities of Dealing with Insurance Companies

The driver’s insurance company policy had a policy limit of $50,000. Unfortunately for Carol, $50,000 didn’t begin to cover her injuries. Carol thought she had extra protection but would soon learn the truth about her own insurance company.

At first, Carol took comfort in the fact she had purchased underinsured motorist coverage and umbrella coverage from Metlife. This means she had her own insurance coverage to pay for her injuries and pay for her changed reality. Carol paid premiums to MetLife on these policies for almost 20 years. However, instead of Metlife agreeing to pay the fair amount to Carol, Metlife said that Carol caused the Jeep to hit her.

The Importance of Choosing the Right Attorney for You

Although Carol has been a fighter her whole life, Carol and her family knew she needed someone to fight for her. From day one, Carol was represented by Attorney Jamison Allen. Marc Lopez Law Firm’s injury partner. Attorney Allen has represented injured people for 16 years, but he once represented insurance companies and knows the strategies insurance companies use to escape responsibility. With the brilliant assistance of Attorney Breanna Huser, paralegal Charity Hornback, and the entire Marc Lopez Law Firm team, Carol fought back against MetLife’s arguments that included:

- Carol took too long to walk to her car and caused the Jeep to hit her;

- The pandemic would’ve hurt Carol and kept her from seeing her friends anyway; and

- Carol’s age would’ve placed her in her current physical condition even if the Jeep didn’t hit her.

After 2½ years, as Carol was waiting for her trial date, MetLife offered to settle for $250,000. Attorney Allen was advised by another injury attorney that his client should take the deal. MetLife would eventually increase its offer to $500,000. Numerous experienced injury attorneys told Attorney Allen his client should settle. These lawyers are professionals with a lot of jury trial experience. They believed Carol would be unlikely to do better at trial because injured elderly people normally see low verdicts due to the complexities of the law and how the law applies to age.

Carol and her family understood the risks but put faith in her attorneys’ ability to get full justice in the courtroom. Carol testified on her own behalf, along with her family doctor, her orthopedic surgeon, her nurse practitioner, her son, and others who knew the devastation the injuries caused in Carol’s life. With hundreds of hours of preparation, Attorneys Allen and Huser showed the jury how wrong MetLife was to deny Carol.

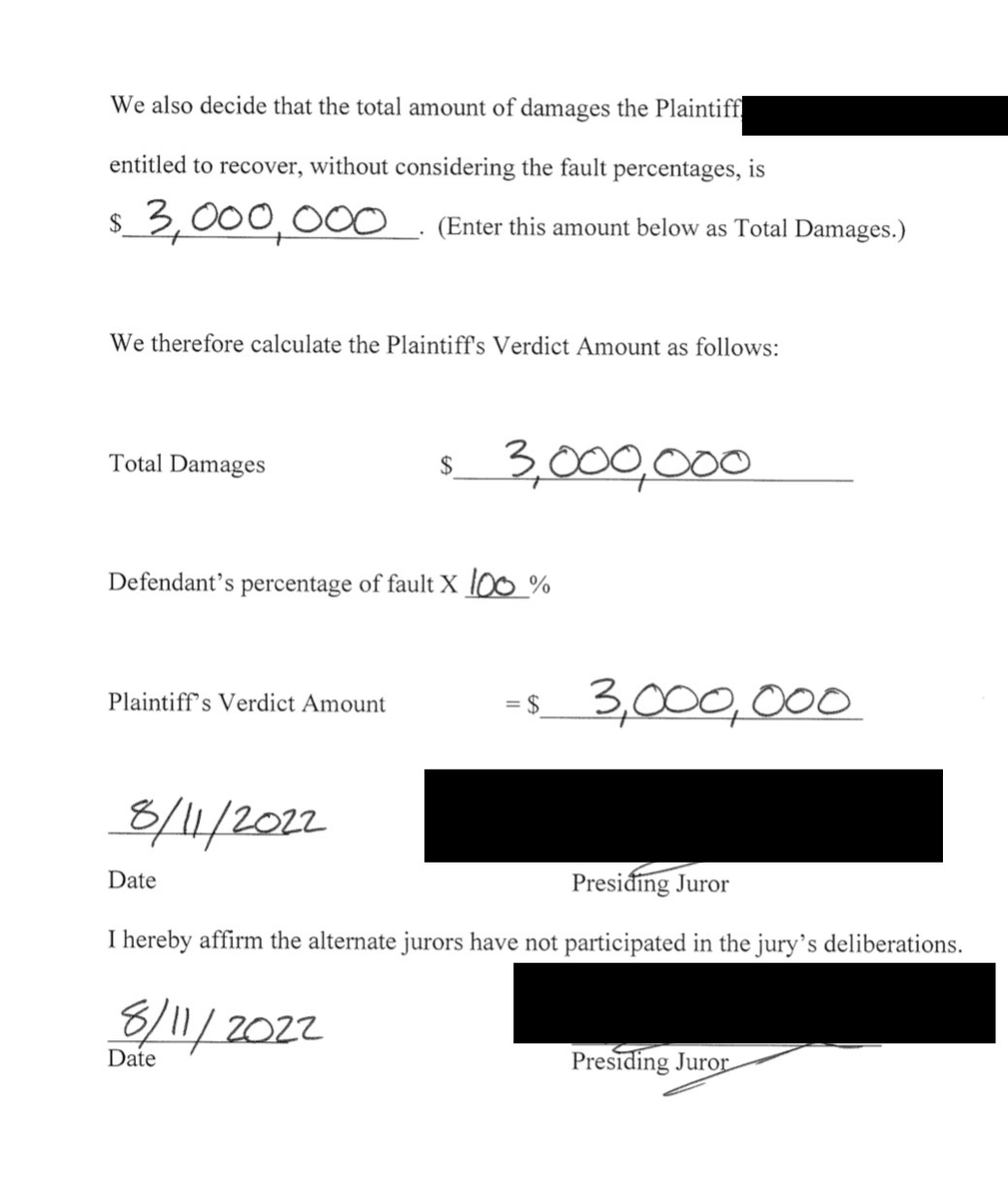

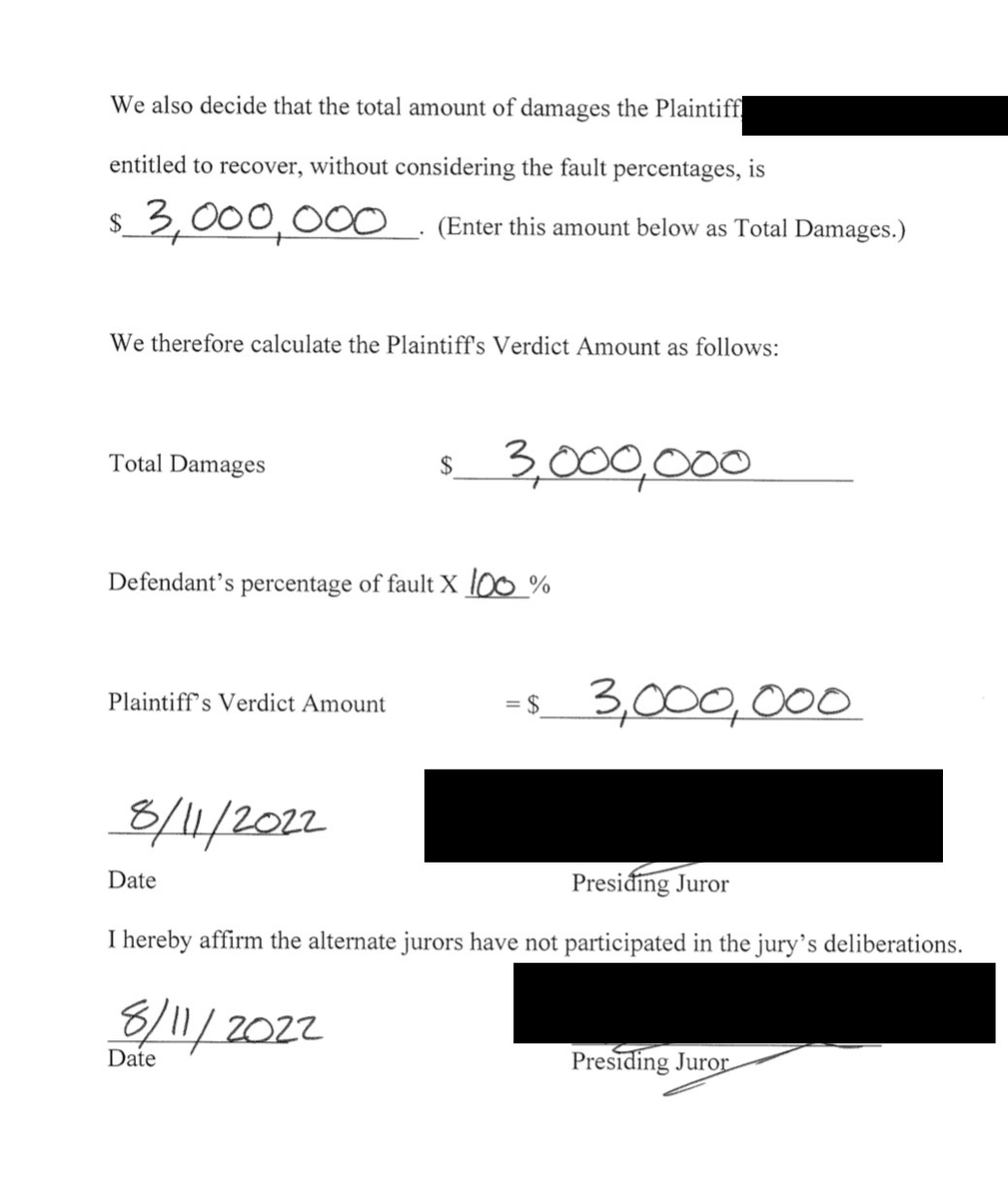

The jury only deliberated about 30 minutes before returning a verdict of $3,000,000 for Carol!

Make the Right Call

The attorneys at the Marc Lopez Law Firm do not run away from a fight. We protect our clients. If a trial is necessary, we go to trial. We know how to win a fight in the courtroom, and we know how to get a fair result.

If someone you love has been mistreated by their own insurance company, we will fight for them just as hard as we fought for Carol. Call 317-632-3642.

Let’s all pay attention while driving. We all count on each other to stay safe.

What happens when a woman in her late 80s is hit by a car and her own insurance company doesn’t want to make good on its policy? If the woman has no way to fight, the insurance company will probably get its way. This is the story of a woman who fought.

Jeep vs. Woman

Carol W.* was exiting a store on foot when a Jeep went in reverse and knocked Carol down. Carol suffered elbow and pelvic fractures and spent three months in physical rehabilitation with various complications. Because of the driver’s negligence, Carol’s life was turned upside-down.

From Being a Walker to Needing a Walker

Before the impact, Carol walked a mile on the treadmill while listening to marching band music and never used a walker or wheelchair. After the impact, Carol was forced to use a walker and wheelchair, which left her unable to walk her dogs or use the stairs at her house. She couldn’t go see her friends whenever she wanted—her independent life was taken from her. The collision made it so that Carol, a vibrant and active elderly person, could no longer live without assistance. From the moment the car hit her, Carol was no longer able to function as an independent adult.

The Realities of Dealing with Insurance Companies

The driver’s insurance company policy had a policy limit of $50,000. Unfortunately for Carol, $50,000 didn’t begin to cover her injuries. Carol thought she had extra protection but would soon learn the truth about her own insurance company.

At first, Carol took comfort in the fact she had purchased underinsured motorist coverage and umbrella coverage from Metlife. This means she had her own insurance coverage to pay for her injuries and pay for her changed reality. Carol paid premiums to MetLife on these policies for almost 20 years. However, instead of Metlife agreeing to pay the fair amount to Carol, Metlife said that Carol caused the Jeep to hit her.

The Importance of Choosing the Right Attorney for You

Although Carol has been a fighter her whole life, Carol and her family knew she needed someone to fight for her. From day one, Carol was represented by Attorney Jamison Allen. Marc Lopez Law Firm’s injury partner. Attorney Allen has represented injured people for 16 years, but he once represented insurance companies and knows the strategies insurance companies use to escape responsibility. With the brilliant assistance of Attorney Breanna Huser, paralegal Charity Hornback, and the entire Marc Lopez Law Firm team, Carol fought back against MetLife’s arguments that included:

- Carol took too long to walk to her car and caused the Jeep to hit her;

- The pandemic would’ve hurt Carol and kept her from seeing her friends anyway; and

- Carol’s age would’ve placed her in her current physical condition even if the Jeep didn’t hit her.

After 2½ years, as Carol was waiting for her trial date, MetLife offered to settle for $250,000. Attorney Allen was advised by another injury attorney that his client should take the deal. MetLife would eventually increase its offer to $500,000. Numerous experienced injury attorneys told Attorney Allen his client should settle. These lawyers are professionals with a lot of jury trial experience. They believed Carol would be unlikely to do better at trial because injured elderly people normally see low verdicts due to the complexities of the law and how the law applies to age.

Carol and her family understood the risks but put faith in her attorneys’ ability to get full justice in the courtroom. Carol testified on her own behalf, along with her family doctor, her orthopedic surgeon, her nurse practitioner, her son, and others who knew the devastation the injuries caused in Carol’s life. With hundreds of hours of preparation, Attorneys Allen and Huser showed the jury how wrong MetLife was to deny Carol.

The jury only deliberated about 30 minutes before returning a verdict of $3,000,000 for Carol!

Make the Right Call

The attorneys at the Marc Lopez Law Firm do not run away from a fight. We protect our clients. If a trial is necessary, we go to trial. We know how to win a fight in the courtroom, and we know how to get a fair result.

If someone you love has been mistreated by their own insurance company, we will fight for them just as hard as we fought for Carol. Call 317-632-3642.

Let’s all pay attention while driving. We all count on each other to stay safe.